40+ Va loan how much can i borrow calculator

If a friend or. To afford a 200K mortgage with a 20 down payment 30-year term and 4 interest rate youd need to make at least 38268 a year before taxes.

Simple Loan Application Form Template Beautiful Personal Loans Calculator India Quick And Easy Cash Contract Template Letter Templates Personal Loans

Pay back the loan as quickly as possible.

. Loan amounts range from 25000 to 150000 with terms of five to 20 years. The results of the above calculator can offer a rough idea of max loan qualification however for most people it is better not to get close to the limit so they have a financial cushion in case of a layoff or a downturn in the broader economy. Based on 70 reviews.

Mortgage pre-qualification is an informal estimate of how much money you can borrow for a home loan. If youre in the market. Todays national mortgage rate trends.

Mortgage insurance typically costs 05 185 percent of your loan amount per year billed monthly though it can go higher or lower depending on your credit score down payment and length of your loan. How much can you borrow. Borrow Little Repay Quickly.

Based on 6 reviews. They can even apply for a new VA loan despite defaulting on a loan from years back. Here is how you can use one to calculate a customized rate.

We can calculate exactly what closing costs will be in your neighborhood by looking at typical fees and taxes associated with closing on a home. Why BMO Harris Bank is the best home equity loan for different loan options. When you take out a mortgage you agree to pay the principal and interest over the life of.

You can borrow as much amount. So with a 20 down payment on a 30-year mortgage and a 4 interest rate youd need to make at least 90000 a year before tax. Borrow money from family or friends.

We assume homeowners insurance is a percentage of your overall home value. A borrower can have 2 VA loans at the same time. On Monday September 12 2022 the current average 30-year fixed-mortgage rate is 608 increasing 3 basis points from a week ago.

The calculator also helps you determine the effects of different interest rates and levels of personal income on how much mortgage you can afford. VA home loans are exclusively given to active military members veterans and. Can I afford a 360k house.

As of March Fed policymakers saw inflation drifting down to 43 percent later this year though that was before the Department of Labors consumer price index CPI showed that prices rose to a. The following table shows loan balances on a 200000 home loan after 5 10 15 20 25 30 35 40 years for loans on the same home. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

How much you ultimately can afford depends on your down payment loan terms taxes and insurance. Amortization means that at the beginning of your loan a big percentage of your payment is applied to interest. Loan repayment terms can range from 24 to 84 months.

Up to 31000 for dependent undergraduates up to 57500 for independent undergraduates up to the full cost of attendance for graduates Varies by lender. Original or expected balance for your mortgage. Certain loan types such as USDA and VA loans do not require a down payment.

Often up to the. A VA loan mortgage calculator is a tool for estimating your monthly payments. Qualified borrowers are also allowed to refinance to a lower rate or shift to an adjustable rate mortgage or fixed-rate loan.

As you can see on the charts the size of a loans funding fee is influenced by several variables. Nearly 35 percent of respondents in 2022 said they would need to borrow the money for such a surprise expense and 49 percent indicated inflation is holding them back from saving money. Estimate your monthly loan repayments on a 250000 mortgage at 4 fixed interest with our amortization schedule over 15 and 30 years.

With each subsequent payment you pay more toward your balance. Depending on the figures that you enter into our Loan Early Repayment Calculator. It usually takes just one to three days and can be done online or over the phone.

Ultimately how much you need to make depends on your down payment loan terms taxes and insurance. PMI will typically cost between 05 and 25 of your loan value annually. This will save you money and will stop you from getting in any financial trouble.

With so many ways to tailor your loan to. Taxpayers can deduct the interest paid on first and second mortgages up to 1000000 in mortgage debt the limit is 500000 if married and filing separately. Your chances of getting approved for a personal loan are much higher.

Veterans Affairs backs VA loans. We use current mortgage information when calculating your home affordability. However the limits do not put a cap on how much you can borrow.

Most lenders require you to have a minimum credit score of 620 a debt-to-income ratio of less than 40. Things to Consider When Taking Out a Loan. This is done through the VA streamlined interest rate reduction refinancing program.

The VA funding fee charts above show the amounts from the VA Handbook for some of the major categories. The cons of a loan that lasts a decade longer has about 50 more total interest expense outweigh the pros of a slightly lower monthly payment or qualifying for a slightly larger loan amount. For their maximum front- and back-end ratios and other factors.

If you cant afford a 20 down payment on your home and apply for a conventional loan youll have to have private mortgage insurance PMI to cover the costs or just plain mortgage insurance for a government loan FHA loans or VA loans for example. Based on 40 reviews. Remember that lenders will still impose a maximum amount you can borrow often 80 percent or 85 percent of your available equity so a new loan or a refinance makes the most sense if the value.

Based on 8 reviews. How much do I need to make to afford a 200000 house. While a longer-term loan will mean a lower monthly cost the longer the lifetime of the loan is the more that you will pay in interest.

The loan is secured on the borrowers property through a process. This calculator is for you if you are reviewing your financial stability as you get ready to purchase a property. To afford a mortgage loan worth 360k you would typically need to make an annual income of about 100k and be able to afford.

VA funding fees vary widely fro m 0 to 36 of the loan amount depending on the veterans military service and type of loan. The less you.

Interest Formula Calculator Examples With Excel Template

Heloc Calculator Calculate Available Home Equity Wowa Ca

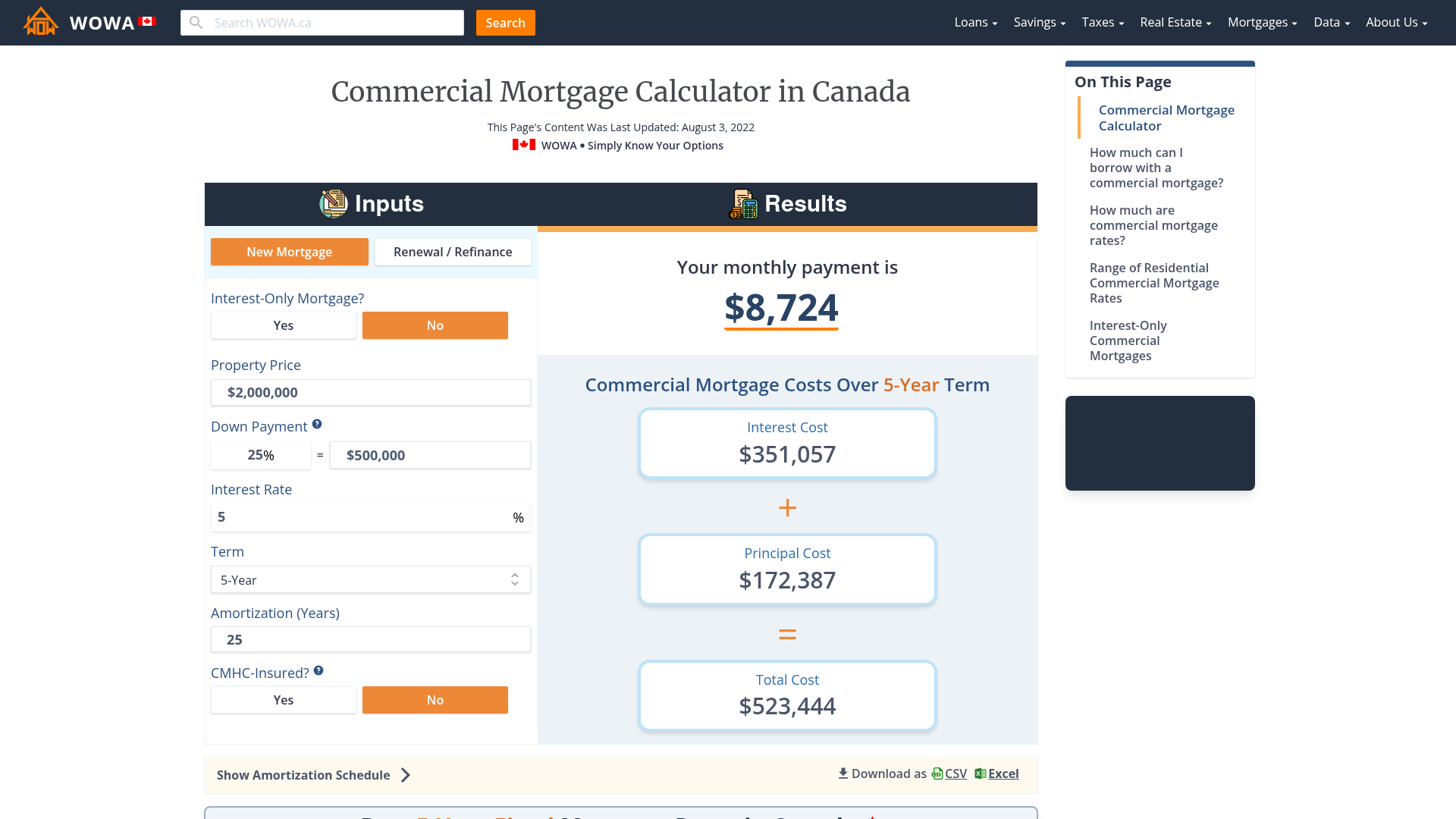

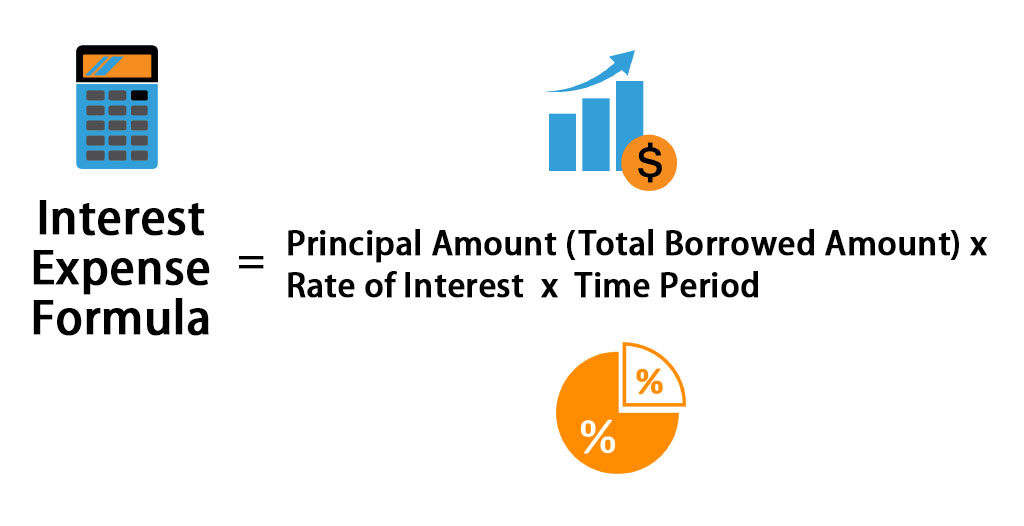

Commercial Mortgage Calculator Payment Amortization

Debt Snowball Calculator Debt Snowball Calculator Interest Calculator Mortgage Payoff

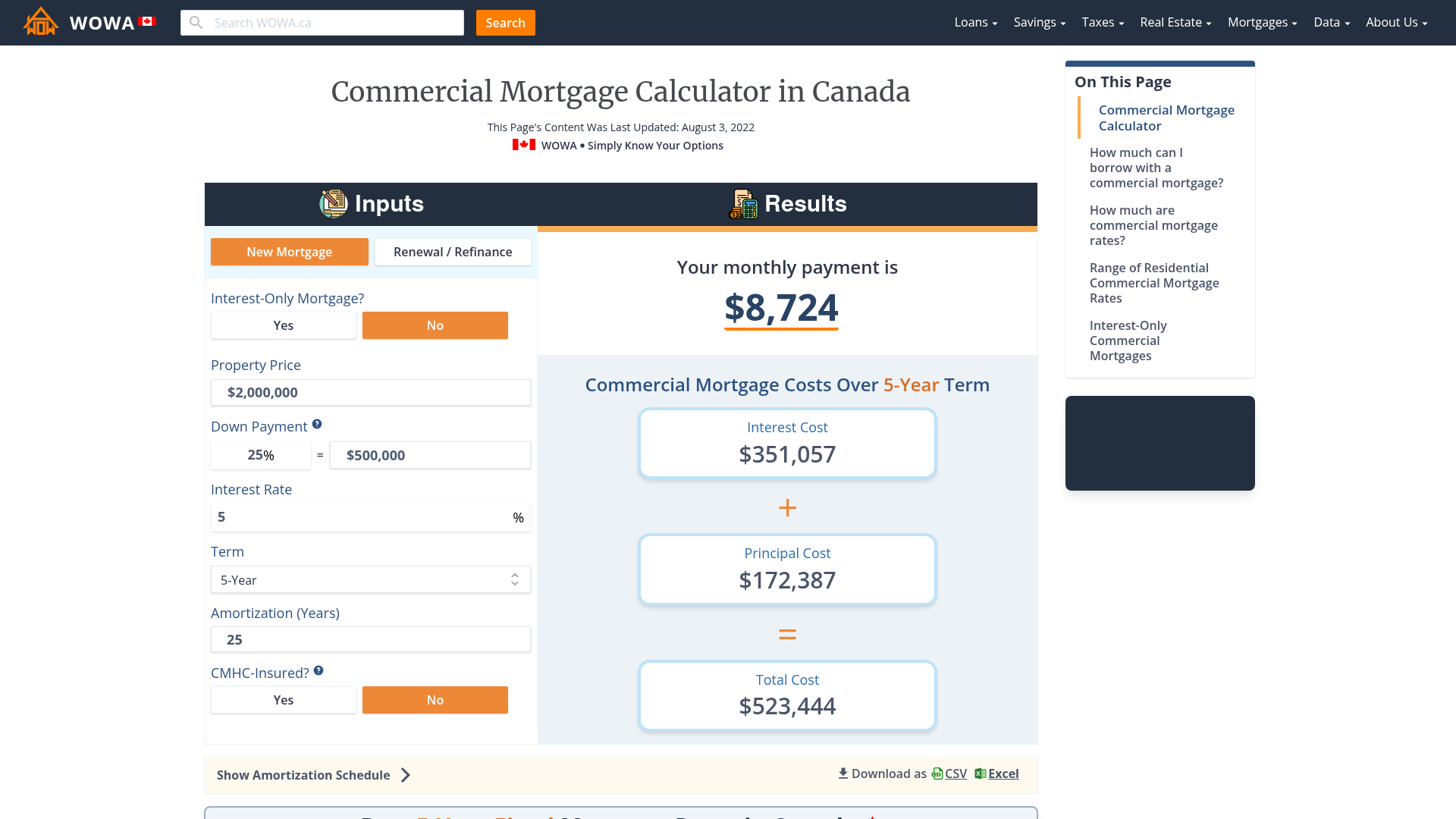

Current Liabilities Formula How To Calculate Current Liabilities

Debt To Income Ratio Formula Calculator Excel Template

Payroll Calculator Template Free Payroll Template Payroll Templates

Effective Annual Rate Formula Calculator Examples Excel Template

Yen Mortgage Loan Calculator How Much Can You Afford To Buy In Japan Blog

How To Use A Mortgage Calculator Comparewise

Tables To Calculate Loan Amortization Schedule Free Business Templates

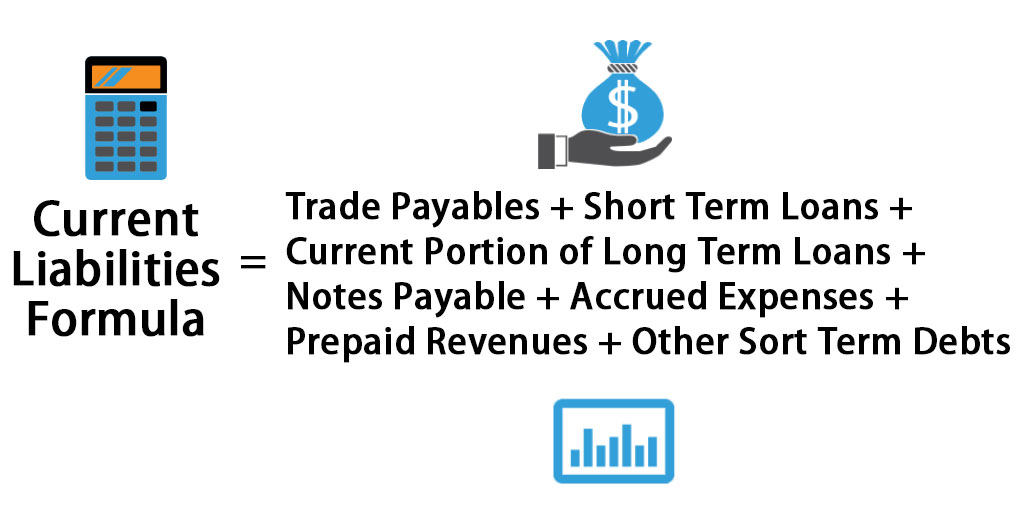

Interest Expense Formula Calculator Excel Template

Simple Loan Application Form Template Beautiful Personal Loans Calculator India Quick And Easy Cash Contract Template Letter Templates Personal Loans

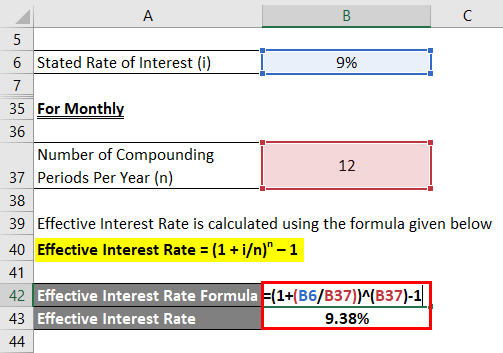

Effective Interest Rate Formula Calculator With Excel Template

How To Calculate Mortgage Payment In Microsoft Excel Quora

Mortgage Interest Calculator Principal And Interest Wowa Ca

Yen Mortgage Loan Calculator How Much Can You Afford To Buy In Japan Blog